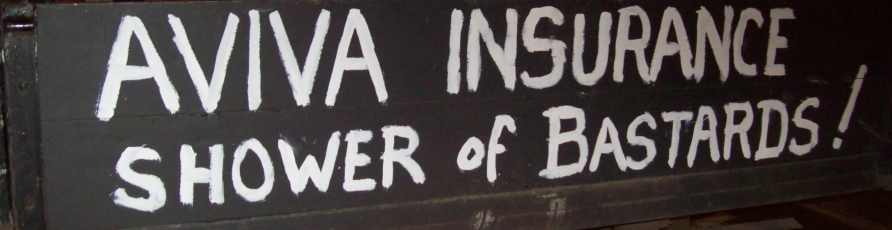

For many years I was a loyal client of AVIVA - this is how they treated me!

In 2015 I bought insurance cover for my two light goods vehicles from Aviva Direct - I accepted their price and paid their premium (expensive but hey ho)

They later wrote or emailed for further information of my No Claims Bonus - ( it was only ever 10%) as I freely admitted two fault claims in the previous three years.

I had difficulty in obtaining proof of NCD from my previous insurers - Zenith via Commercial Vehicles Direct so I suggested Aviva make contact themselves.

I heard nothing further until Aviva wrote a letter dated 17th November 2015 saying that they had CANCELLED my policies on 21st October 2015 - which had made me a criminal for over three weeks! (They've later denied this but the fact remains - they sent the letter - black and white: insurance cancelled!!!) I reckon its quite obvious that if I'd had an accident during this "uninsured" period - they'd have walked away.

Being put on the spot, out and about in an uninsured vehicle and a failing mobile battery - my only option was to reinsure with them at a grossly inflated cost! A further £900 - a staggering increase and I believe entirely unfair.

Investigating further.

Despite Aviva cancelling my cover, it was extremely difficult to find out exactly why they'd done so...... "erm... we can't say... data protection.... we suggest you contact your previous insurers" (I'll leave you to guess what Father Jack would say about menu phones!)

Suffice it to say I discovered that after buying my new Aviva insurance my previous insurers had been contacted by a claimant and had paid him out!!! This made me look like a liar through failing to disclose. However; and this is BIG however! The claimant was being investigated for FRAUD as he had made other bogus claims and gross exaggerations in what's known as the scam of "crash for cash." (I have written evidence.)

THIS CLAIM HAS NOW BEEN DROPPED!

Aviva later acknowledged my TWO YEARS N.C.D but still have not returned my money and don't care - I have a string of emails from - Stuart Colby (get his title) Aviva's Director of Customer Experience saying as much. He denies any involvement with the police interest in the case - but you are free to wonder.

I would be the first to agree that Aviva have the perfect right to charge what they like in the normal way of business but it is also incumbent upon them to act in good faith being a giant concern, let alone one with a Director of Customer Experience.

As it is their charges to me are inflated, as they were based on the FRAUDULENT information now PROVED to be false by a well known industry investigative lawyer - yet they think it fair to keep my £900.00!

They are rumoured to have £70 BILLION under management!!! My money is a fraction of the interest they get every hour.

Very little has changed in TEN YEARS except I see that Stuart Colby has had even more efflusiveness added to his illustrious title - he is now Senior Complaint Specialist (CEO Office) Customer Experience! I expect he has plenty of work to do.

His email - stuart.colby@aviva.com if you've a complaint - he's yer man!